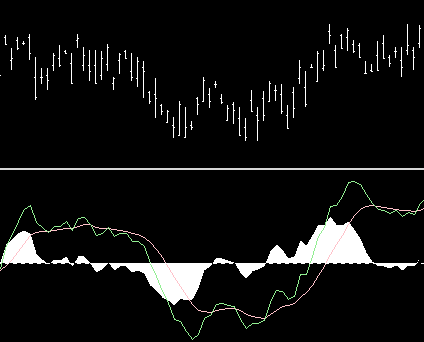

The MACD (Moving Average Converenge Divergence) is a calculation in technical analysis used as a indicator of strength in a trend, or momentum in a stocks closing prices. The calculation uses different lengths of EMA (I covered the calculation of EMA in an earlier blog post here).

The MACD calculation uses the difference between a long EMA and a short EMA to create a oscillator (usually EMA12 – EMA26). The term Moving Average Converenge Divergence comes from the converging and divergence of these two moving averages. When the two moves towards each other there is convergence, and when they move away from each other, there is divergence. A divergence is commonly interpreted as a sign that the current trend is ending.

The MACD also moves around a zero line and when the MACD is above the zero line, that is used as a indicator of upward momentum (higher closing prices) since the short term EMA is above the long term EMA. And of course, if MACD is below the zero line this is an indicator of downward momentum.

White histogram is the difference between the two.

Further, a EMA9 is calculated for the MACD. This line is called the “Signal line”. The signal line is used in a trigger for buy and sell signals. More specifically, traders look for crossovers of the two lines. When the MACD moves over the MACD:EMA9, this is a buy signal since it indicates a upward momentum (a bullish market) of the closing prices. And when the MACD crosses under the MACD:EMA9, this is a sell signal since this is a indicator of downward momentum (bearish market).

This blog post will show how to calculate MACD in T-SQL. It works on all versions of SQL Server.

The examples use the database TAdb. A script to create TAdb can be found here.

Using a extended version of the EMA calculation, the T-SQL below calculates EMA12, EMA26 and MACD:

IF OBJECT_ID('tempdb..#TBL_EMA_LOOP') IS NOT NULL BEGIN

DROP TABLE #TBL_EMA_LOOP

END

SELECT *, CAST(NULL AS FLOAT) AS EMA12, CAST(NULL AS FLOAT) AS EMA26 INTO #TBL_EMA_LOOP FROM dbo.Quotes

CREATE UNIQUE CLUSTERED INDEX EMA_IDX ON #TBL_EMA_LOOP (StockId, QuoteId)

DECLARE @StockId INT = 1, @QuoteId INT, @QuoteIdMax INT, @StartAvgEMA12 FLOAT, @StartAvgEMA26 FLOAT, @C_EMA12 FLOAT = 2.0 / (1 + 12), @C_EMA26 FLOAT = 2.0 / (1 + 26), @EMA12 FLOAT, @EMA26 FLOAT

WHILE @StockId <= 2 BEGIN

SELECT @QuoteId = 1, @QuoteIdMax = MAX(QuoteId) FROM dbo.Quotes WHERE StockId = @StockId

SELECT @StartAvgEMA12 = AVG(QuoteClose) FROM dbo.Quotes WHERE StockId = @StockId AND QuoteId <= 12

SELECT @StartAvgEMA26 = AVG(QuoteClose) FROM dbo.Quotes WHERE StockId = @StockId AND QuoteId <= 26

WHILE @QuoteId <= @QuoteIdMax BEGIN

UPDATE

T0

SET

EMA12 =

CASE

WHEN @QuoteId = 12 THEN @StartAvgEMA12

WHEN @QuoteId > 12 THEN (T0.QuoteClose * @C_EMA12) + T1.EMA12 * (1.0 - @C_EMA12)

END

,EMA26 =

CASE

WHEN @QuoteId = 26 THEN @StartAvgEMA26

WHEN @QuoteId > 26 THEN (T0.QuoteClose * @C_EMA26) + T1.EMA26 * (1.0 - @C_EMA26)

END

FROM

#TBL_EMA_LOOP T0

JOIN

#TBL_EMA_LOOP T1

ON

T0.StockId = T1.StockId

AND

T0.QuoteId - 1 = T1.QuoteId

WHERE

T0.StockId = @StockId

AND

T0.QuoteId = @QuoteId

SELECT @QuoteId = @QuoteId + 1

END

SELECT @StockId = @StockId + 1

END

SELECT

StockId

,QuoteId

,QuoteDay

,QuoteClose

,CAST(EMA12 AS NUMERIC(10,2)) AS EMA12

,CAST(EMA26 AS NUMERIC(10,2)) AS EMA26

,CAST(EMA12 - EMA26 AS NUMERIC(10,2)) AS MACD

FROM

#TBL_EMA_LOOP

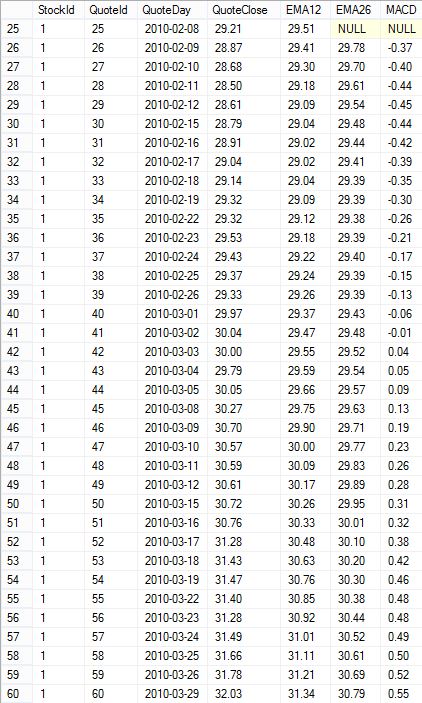

A sample of the results look like this:

In this example, following the theory stated above, the stock is in a negative momentum (bearish market) up until 2010-03-03 when a crossover occurs and the stock enters a positive momentum (bullish market). And indeed, the stock price rises between 2010-03-03 and 2010-03-29. (If you do the query yourself you will see that the positive momentum lasts up until 2010-05-20 ending at a closing price of 31.78.)

[blue_box]This blog post is part of a serie about technical analysis, TA, in SQL Server. See the other posts here.[/blue_box]

At the moment I can only complemeny you and you work. Genius!!!

I tested your calculation….it’s perfect. Your amazing. I’ve been searching for 3 days now. I must repeat. GENIUS.

Thanks, glad to hear it is working!

Hey – just wanted to say thank you for keeping this up and up to date with sql server 2012 — personally i am working on 2008 so i REALY appreciate the nod at older RDBMS’

using this and a few others I can figure out how to implement the other technical indicators I need to write.

Thank you and please keep this archive alive

Thanks, Felix!

Hi ..

i’m trying to find stochastic(%K,%D) script

can you help me ?

Thanks in advance

Hi, I haven’t done that calculation in T-SQL. Can’t remember seeing it anywhere either…

Hi Shahram, this seems to work for calculating a 14 day Stochastic with 3 day and 5 day moving averages:

/*

Calculate Stochastic Oscillator

%K = (Current Close – Lowest Low)/(Highest High – Lowest Low) * 100

%D = 3-day SMA of %K

Lowest Low = lowest low for the look-back period

Highest High = highest high for the look-back period

%K is multiplied by 100 to move the decimal point two places

Fast Stochastic Oscillator:

– Fast %K = %K basic calculation

– Fast %D = 3-period SMA of Fast %K

Slow Stochastic Oscillator:

– Slow %K = Fast %K smoothed with 3-period SMA

– Slow %D = 3-period SMA of Slow %K

*/

USE StockMarket

GO

IF OBJECT_ID(‘StockMarket.dbo.usp_CalculateStochastic’) IS NOT NULL BEGIN

DROP PROCEDURE dbo.usp_CalculateStochastic

END

GO

CREATE PROCEDURE dbo.usp_CalculateStochastic

AS

SET NOCOUNT ON

SET ANSI_WARNINGS OFF

BEGIN

IF OBJECT_ID(‘tempdb..#Stoch’) IS NOT NULL BEGIN

DROP TABLE #Stoch

END

/* Create Temp Table */

SELECT *,

CAST(NULL AS FLOAT) AS HighestHigh14,

CAST(NULL AS FLOAT) AS LowestLow14,

CAST(NULL AS FLOAT) AS StochFast14,

CAST(NULL AS FLOAT) AS SMAFast3,

CAST(NULL AS FLOAT) AS SMAFast5,

CAST(NULL AS FLOAT) AS StochSlow14,

CAST(NULL AS FLOAT) AS SMASlow3,

CAST(NULL AS FLOAT) AS SMASlow5

INTO #Stoch

FROM StockMarket.dbo.HistoricalStockPrices

WHERE MarketDate >= ( GetDate() – 380 )

CREATE UNIQUE CLUSTERED INDEX Stoch_IDX ON #Stoch (Ticker, MarketDate)

DECLARE @Ticker VARCHAR(5),

@MarketDate DateTime,

@MarketDateMin DateTime,

@MarketDateMax DateTime,

@HighestHigh14 FLOAT,

@LowestLow14 FLOAT

/* Set first ticker */

SELECT @Ticker = ( SELECT TOP 1 Ticker

FROM #Stoch h

ORDER BY h.Ticker )

WHILE @Ticker <= 'ZX'

BEGIN

SELECT @MarketDate = MIN(MarketDate),

@MarketDateMin = MIN(MarketDate),

@MarketDateMax = MAX(MarketDate)

FROM #Stoch

WHERE Ticker = @Ticker

WHILE @MarketDate <= @MarketDateMax

BEGIN

/* Get Highest Highs and Lowest Lows */

SELECT @HighestHigh14 = Max(HighPrice),

@LowestLow14 = MIN(LowPrice)

FROM ( SELECT TOP 14

MarketDate,

HighPrice,

LowPrice

FROM #Stoch

WHERE Ticker = @Ticker

AND MarketDate <= @MarketDate

ORDER BY MarketDate DESC ) vt

/* Need to update Stoch Fast 14 first as other other calculations are dependend upon it */

UPDATE s

SET HighestHigh14 = @HighestHigh14,

LowestLow14 = @LowestLow14,

/* (Current Close – Lowest Low)/(Highest High – Lowest Low) * 100 */

StochFast14 = CASE WHEN ( @HighestHigh14 – @LowestLow14 ) = 0

THEN ( ( s.ClosePrice – @LowestLow14 ) / ( .01 ) ) * 100 /* Setting to .01 cent to avoid divide by zero error */

ELSE ( ( s.ClosePrice – @LowestLow14 ) / ( @HighestHigh14 – @LowestLow14 ) ) * 100 END

FROM #Stoch s

WHERE s.Ticker = @Ticker

AND s.MarketDate = @MarketDate

/* Update values based on Stoch Fast 14 */

UPDATE s

SET /* 3-period SMA of Fast Stoch */

SMAFast3 = (SELECT Avg(StochFast14)

FROM ( SELECT TOP 3

MarketDate,

StochFast14

FROM #Stoch

WHERE Ticker = @Ticker

AND MarketDate <= @MarketDate

ORDER BY MarketDate DESC ) vt ),

/* 5-period SMA of Fast Stoch */

SMAFast5 = (SELECT Avg(StochFast14)

FROM ( SELECT TOP 5

MarketDate,

StochFast14

FROM #Stoch

WHERE Ticker = @Ticker

AND MarketDate <= @MarketDate

ORDER BY MarketDate DESC ) vt ),

/* Fast Stoch smoothed with 3-period SMA */

StochSlow14 = ( SELECT Avg(StochFast14)

FROM ( SELECT TOP 3

MarketDate,

StochFast14

FROM #Stoch

WHERE Ticker = @Ticker

AND MarketDate <= @MarketDate

ORDER BY MarketDate DESC ) vt )

FROM #Stoch s

WHERE s.Ticker = @Ticker

AND s.MarketDate = @MarketDate

/* Update values based on Stoch Slow 14 */

UPDATE s

SET /* 3-period SMA of Slow Stoch */

SMASlow3 = (SELECT Avg(StochSlow14)

FROM ( SELECT TOP 3

MarketDate,

StochSlow14

FROM #Stoch

WHERE Ticker = @Ticker

AND MarketDate <= @MarketDate

ORDER BY MarketDate DESC ) vt ),

/* 5-period SMA of Slow Stoch */

SMASlow5 = (SELECT Avg(StochSlow14)

FROM ( SELECT TOP 5

MarketDate,

StochSlow14

FROM #Stoch

WHERE Ticker = @Ticker

AND MarketDate @MarketDate

ORDER BY h.MarketDate )

END

SELECT @Ticker = ( SELECT TOP 1 Ticker

FROM #Stoch h

WHERE h.Ticker > @Ticker

ORDER BY h.Ticker )

END

/* Truncate Stochastic Table */

TRUNCATE TABLE StockMarket.dbo.Stochastic

/* Populate Stochastic Table */

INSERT INTO StockMarket.dbo.Stochastic

SELECT Ticker

,MarketDate

,HighPrice

,LowPrice

,ClosePrice

,CAST(HighestHigh14 AS NUMERIC(10,2)) AS HighestHigh14

,CAST(LowestLow14 AS NUMERIC(10,2)) AS LowestLow14

,CAST(StochFast14 AS NUMERIC(10,2)) AS StochFast14

,CAST(SMAFast3 AS NUMERIC(10,2)) AS SMAFast3

,CAST(SMAFast5 AS NUMERIC(10,2)) AS SMAFast5

,CAST(StochSlow14 AS NUMERIC(10,2)) AS StochSlow14

,CAST(SMASlow3 AS NUMERIC(10,2)) AS SMASlow3

,CAST(SMASlow5 AS NUMERIC(10,2)) AS SMASlow5

FROM #Stoch

ORDER BY Ticker, MarketDate

END;

These scripts are great, thank you for your efforts! Have you ever implemented one for SAR?

Thanks you are amazing, Is it possible to find divergence in MACD ?

Hello

i want to calculate MACD FOR ALL SYMBOL

CAN U HELP ME